Best Exchange Rate and Cheapest International Wire Transfer Service

Ever feel that it costs quite a bit to send money overseas. Check out this service and save money on your next international wire transfer.

What are Buy, Sell and Mid Market Rates

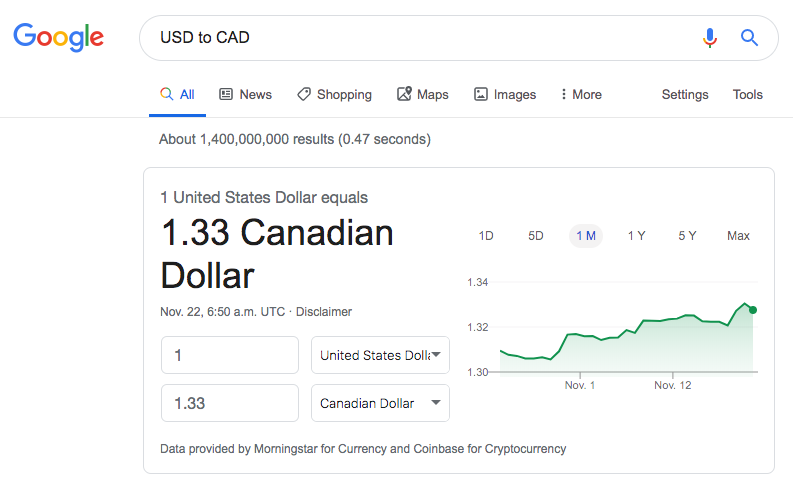

When we search on Google ‘USD to CAD’, we can see an exchange rate calculator similar to picture below.

However, when we check currency exchange rates at banks, currency exchange shops or websites, we can see that each currency has “buy” and “sell” rates. These are the rates that currency exchange service providers willing to trade at. The rates they use affects the cost of our currency exchange and international wire transfer.

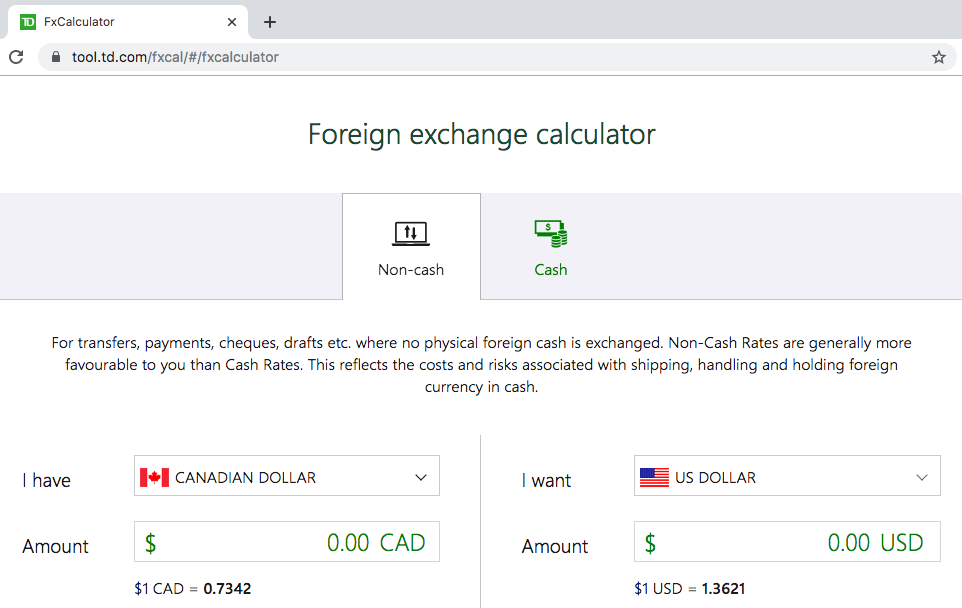

For example, you can check TD Bank’s foreign exchange calculator. The following screenshot shows USD and CAD exchange rates provided by TD Bank.

The (approximate) exchange rate we get via Google search is

1 USD = 1.33 CAD

However, on TD Bank page, we see

1 USD = 1.3621 CAD

That means, if we want to buy USD from TD Bank, we pay 1.3621 CAD to get 1 USD. However, based on the exchange rate via Google search, it should be 1.33 CAD for 1 USD.

That means for every USD that we buy from TD Bank, TD Bank probably makes around 0.0321 CAD(1.3621 - 1.33) for every USD that we buy using CAD. In other words, when we buy 1000 USD, TD Bank probably makes 32.1 CAD.

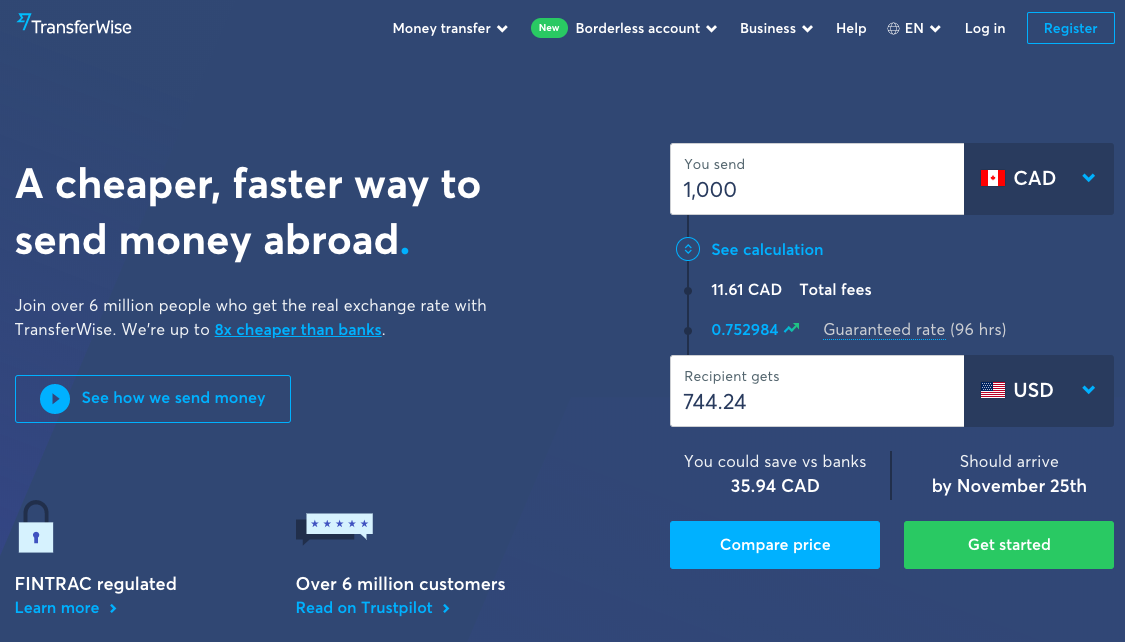

On the other hand, TransferWise facilitates international currency exchange using mid market rate which is the rate we see on Google, XE and Yahoo Finance.

Logically, then, mid market rate is then the middle rate between buying and selling prices of currency markets. To read more about mid market rate.

Foreign Exchange Service

According to Wikipedia, TransferWise is described as following:

TransferWise is a British online money transfer service founded in January 2011 by Estonians Kristo Käärmann and Taavet Hinrikus and is based in London. The company supports more than 750 currency routes across the world including GBP, USD, EUR, AUD and CAD, and provides multi-currency accounts.

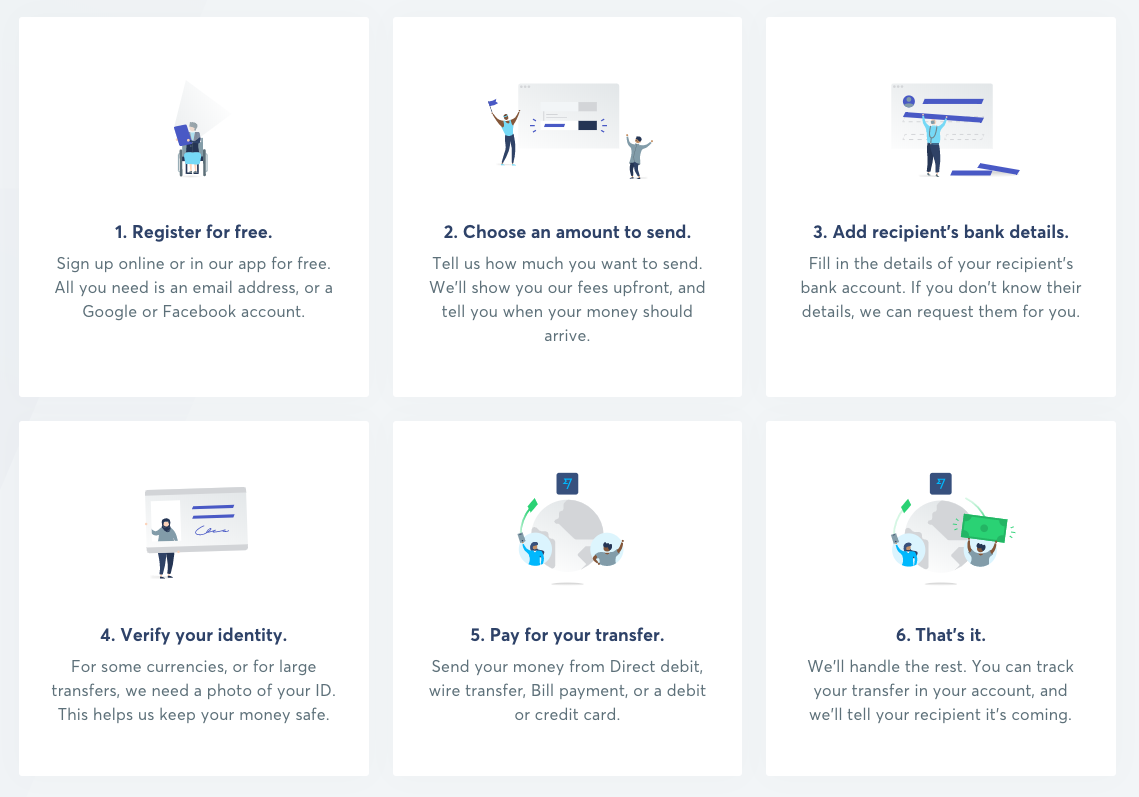

International Wire Transfer Steps

This diagram summarizes the steps to use do internation wire transfer using TransferWise.

If you would like to get discount for your first international wire transfer with TransferWise, feel free to message me.

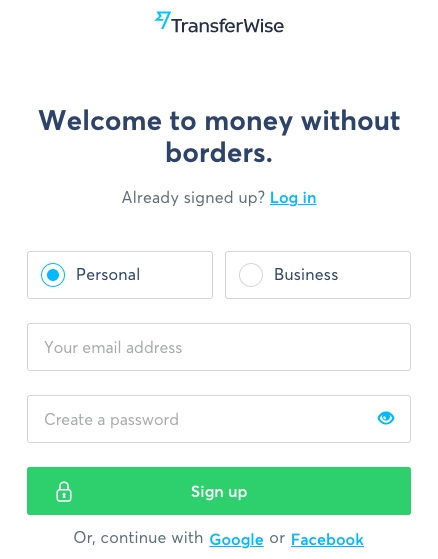

1 Sign up for an account

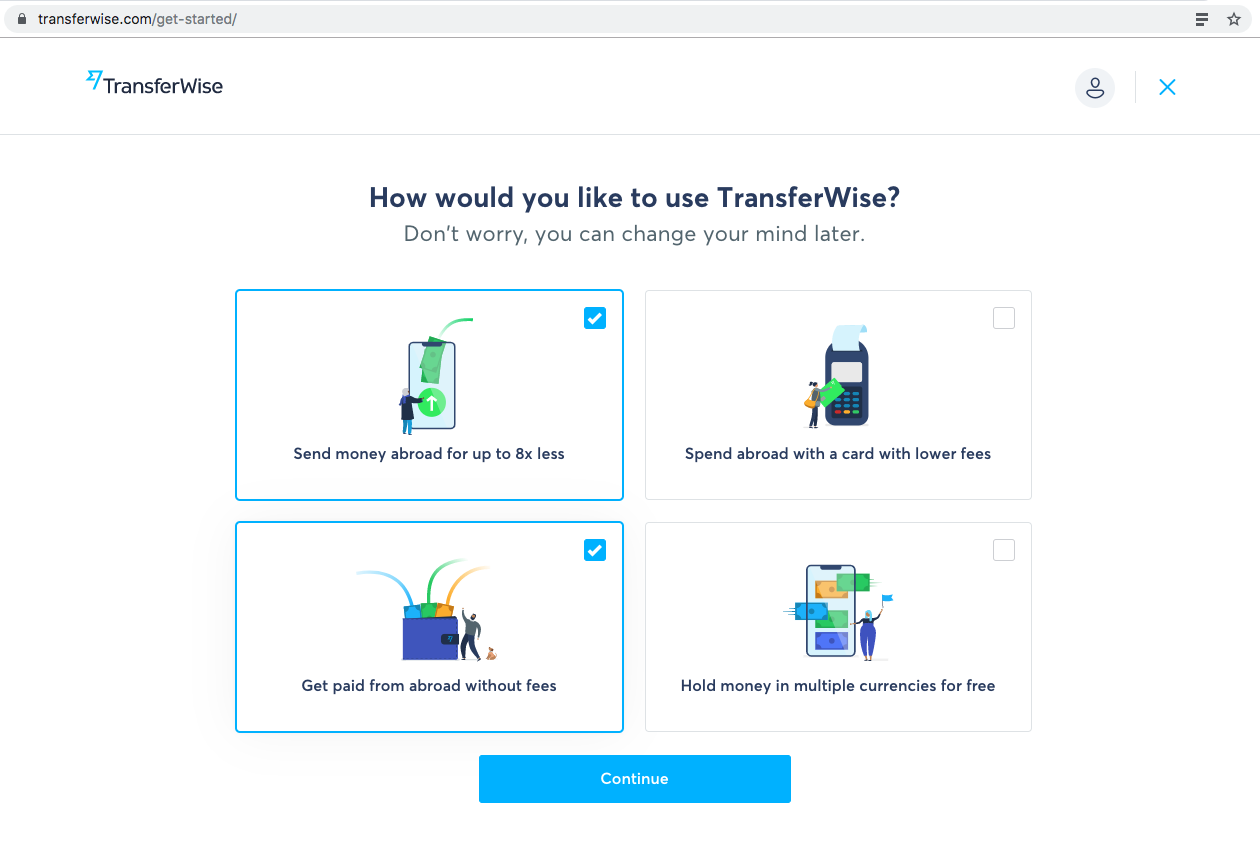

2 Onboarding Survey

There is any onboarding survey that you have to answer to tell TransferWise how you gonna use it.

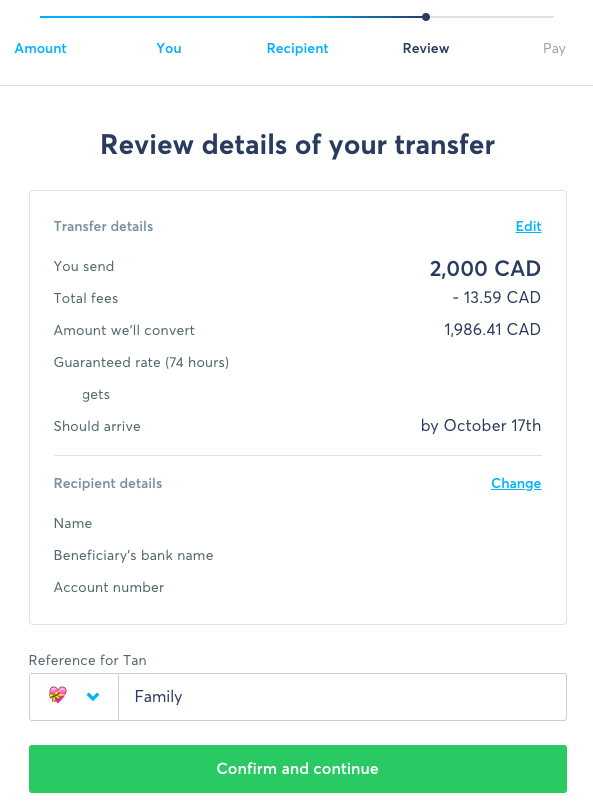

3 Transfer Flow

Next, you will fill out some information regarding your money transfer through a series of steps (Amount - You - Recipient - Review - Pay). Follow the explanation and diagrams below for a walkthrough.

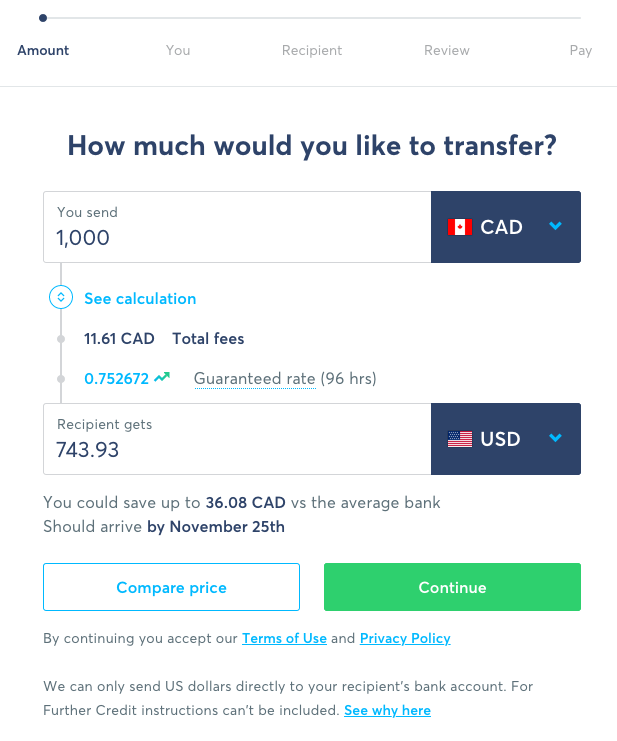

Amount

Specify the currency and amount that you want to transfer. The exchange rate is guaranteed if your money arrives at TransferWiseaccount within the next set period of time (e.g. 96 hours in my case).

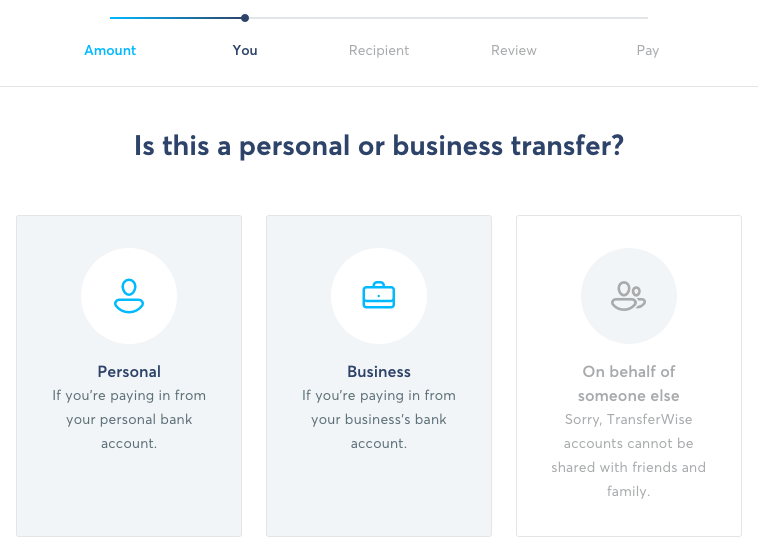

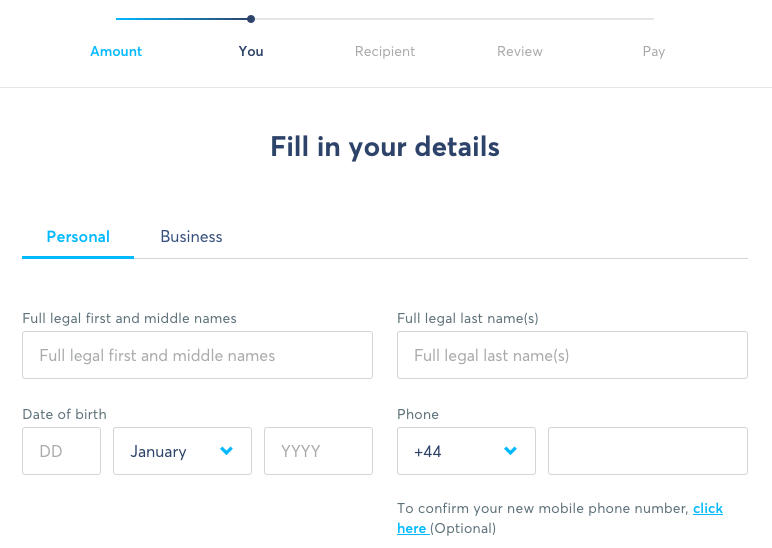

You

Fill out your personal information that is needed for money transfer.

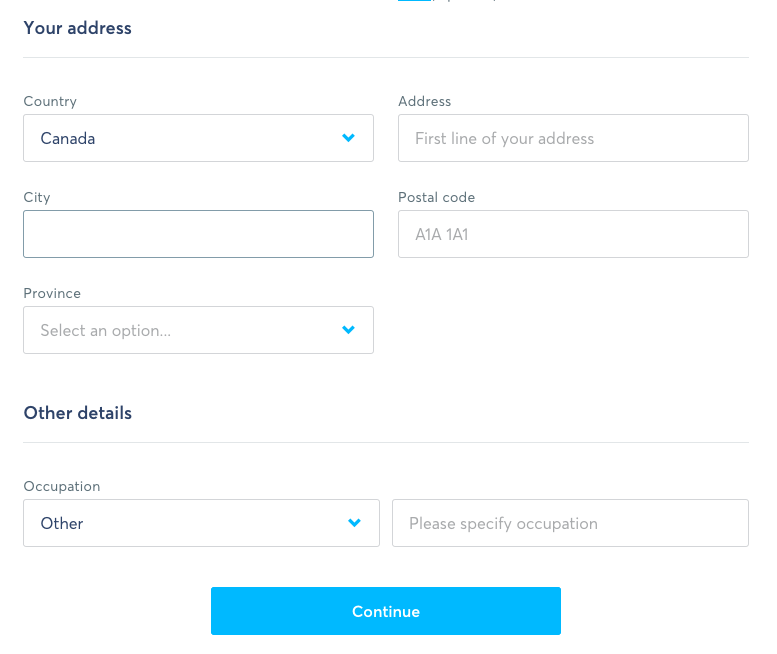

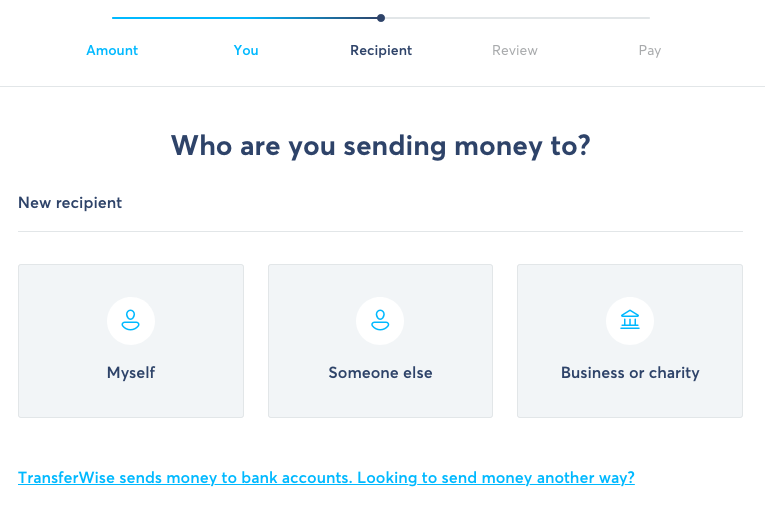

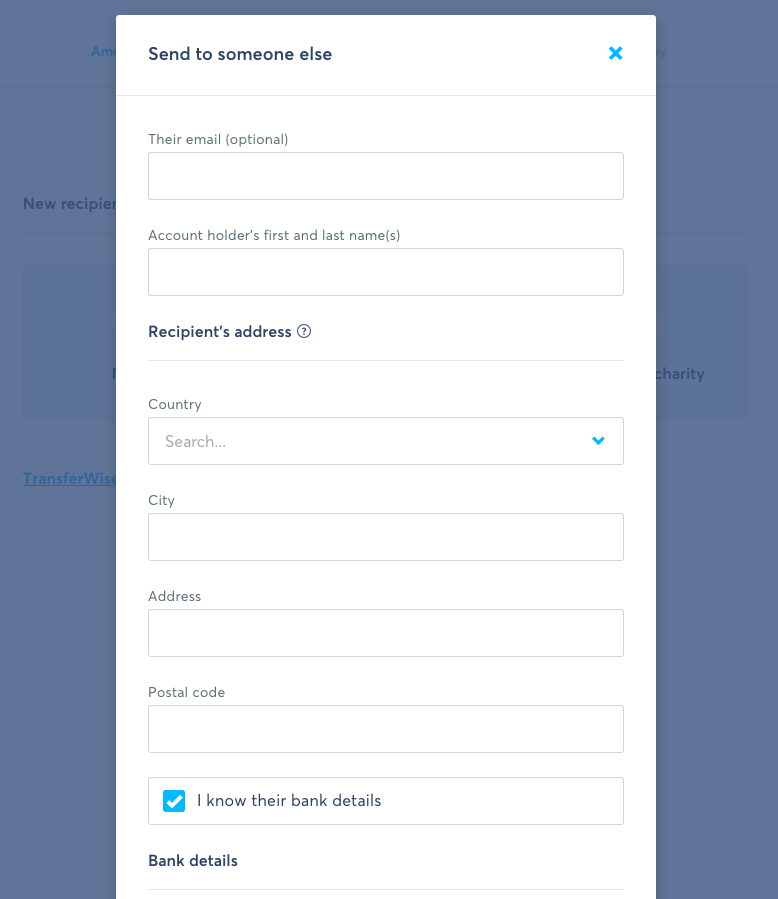

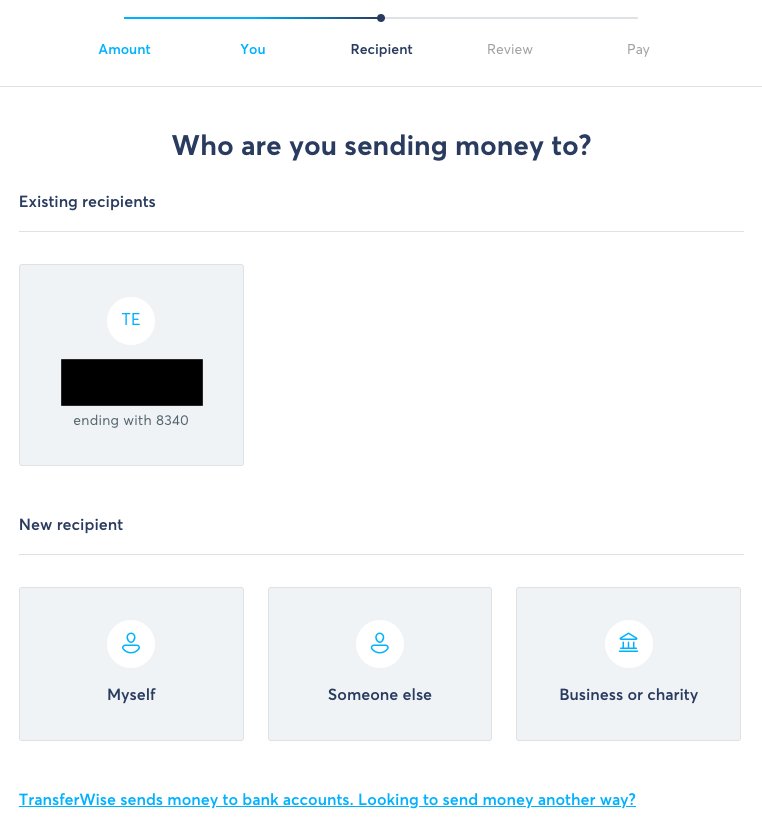

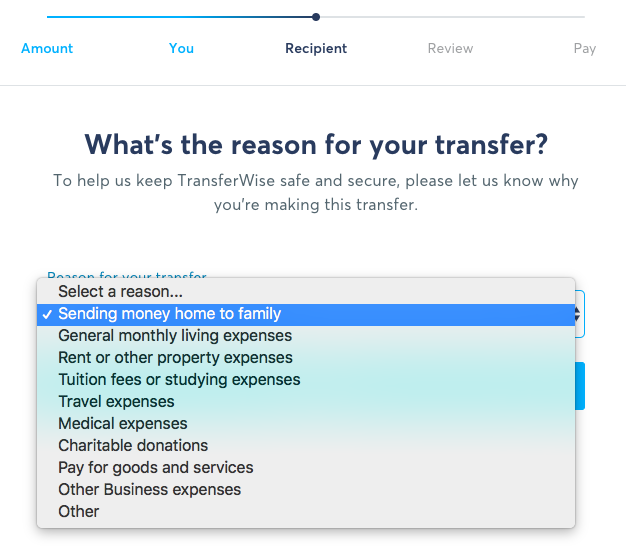

Recipient

Fill out your money transfer recipient’s information such as name, address and bank details.

After you add a recipient, a recipient card will be added to the list of existing recipients.

Next, you need to specify the reason for transferring money.

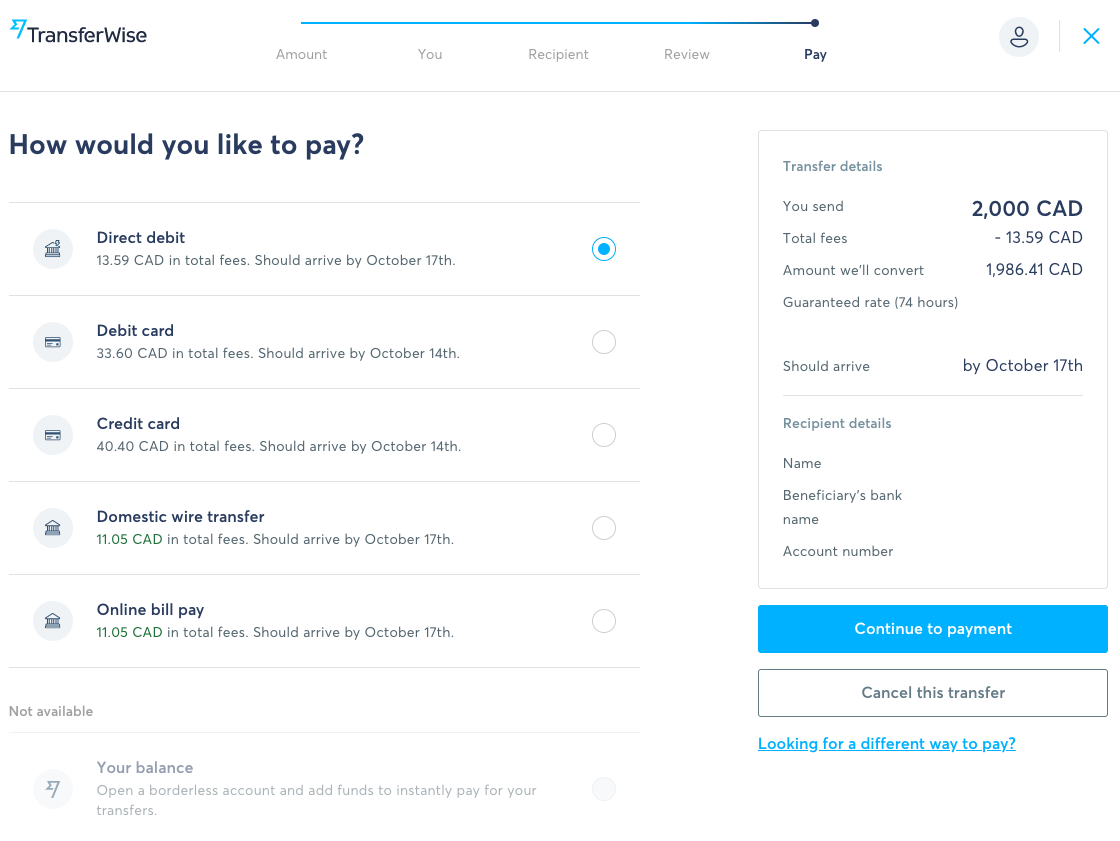

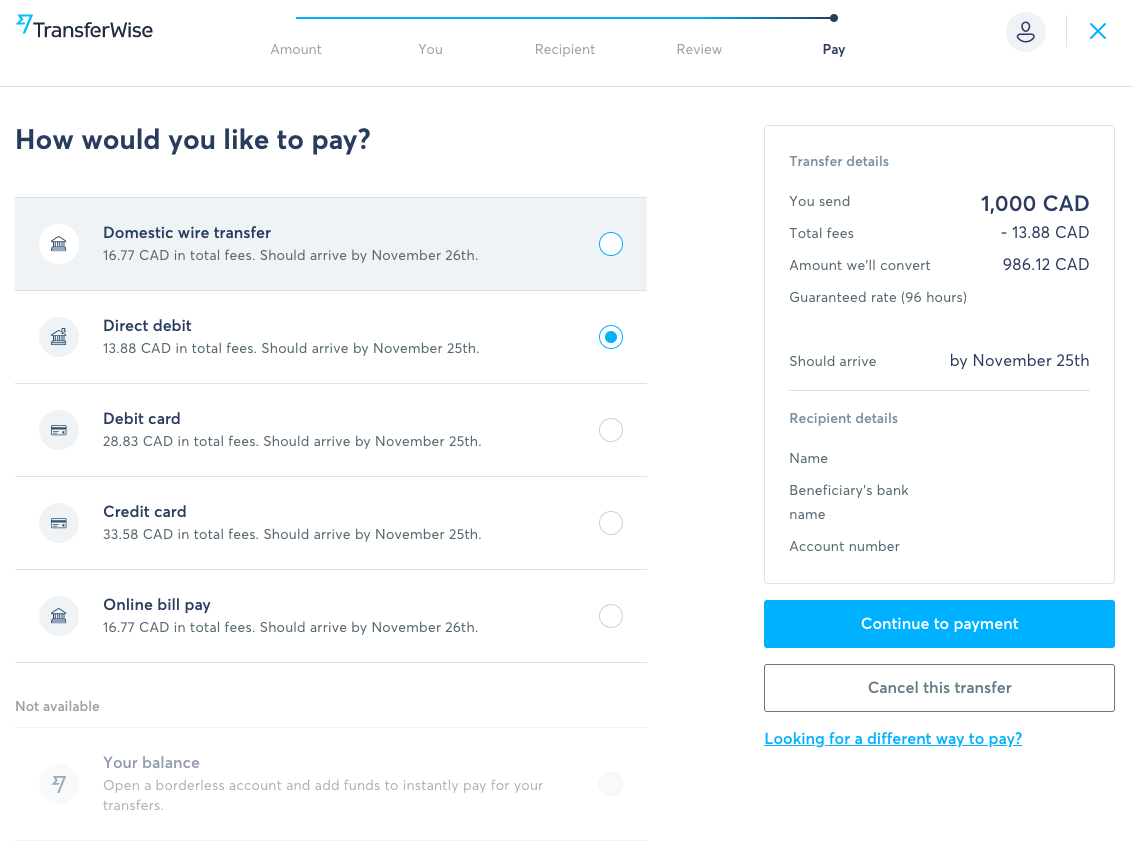

pay

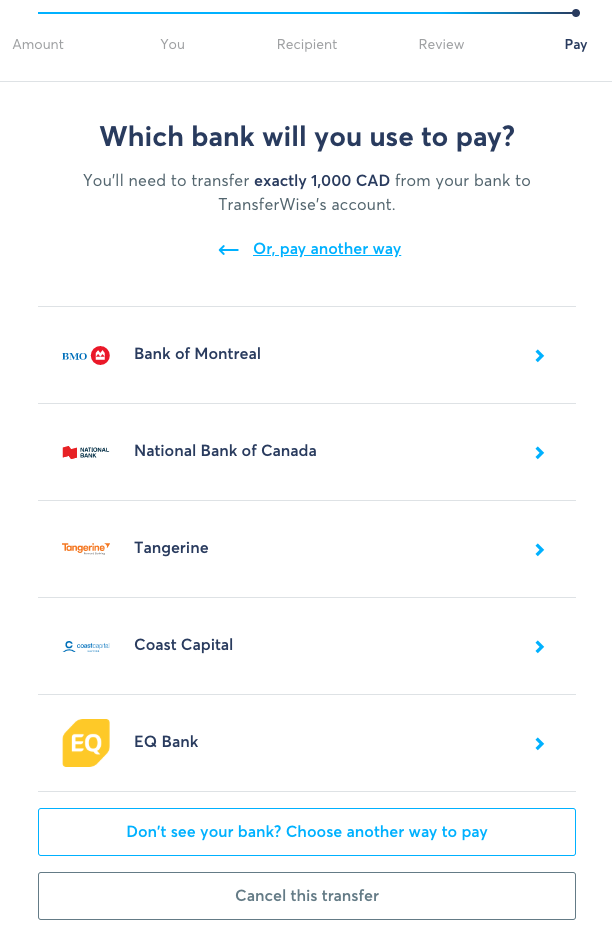

How do you transfer money / pay TransferWise? At the pay stage, TransferWise lists a few payment methods and price for each payment methods is different. Based on two uses, I noticed that online bill pay, domestic wire transfer and direct debit are probably the cheapest options.

Cheaper Payment Methods

I find that direct debit and online bill pay are quite easy to set up. I believe it also depends on countries. Thus, choose the method that is most convenient for you.

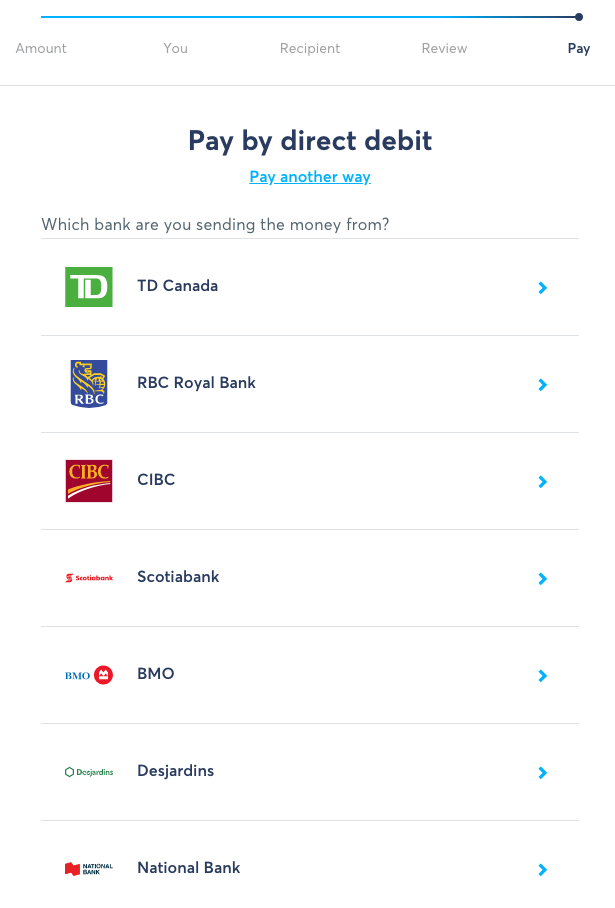

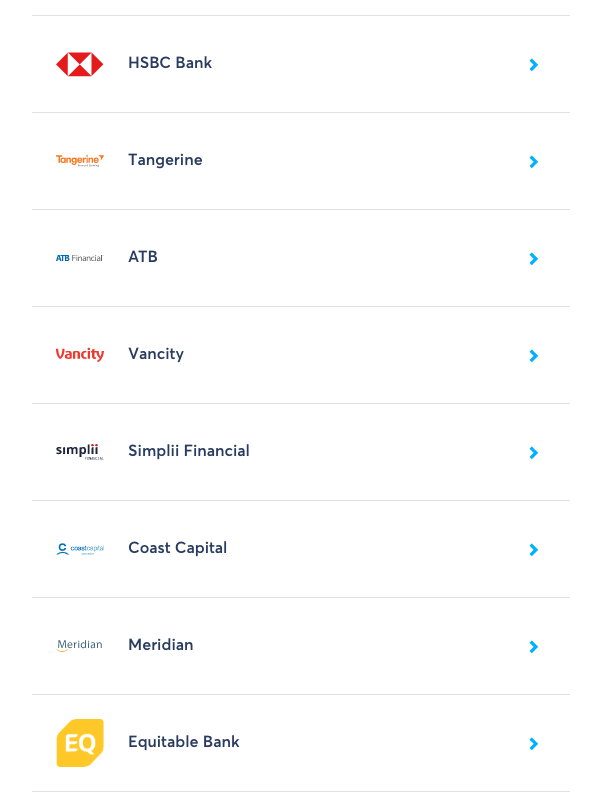

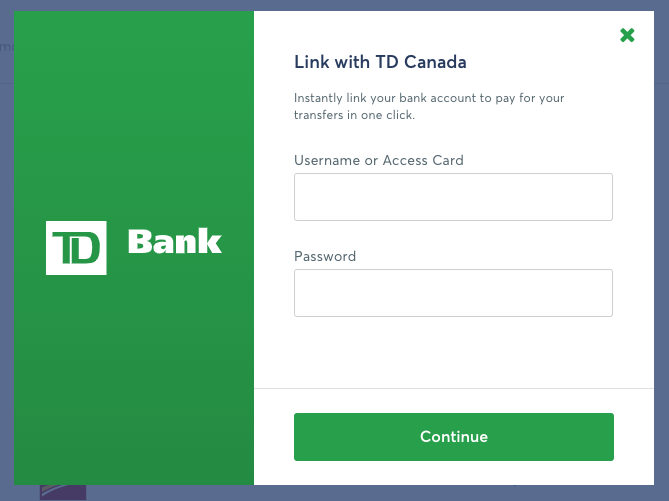

1 Direct Debit

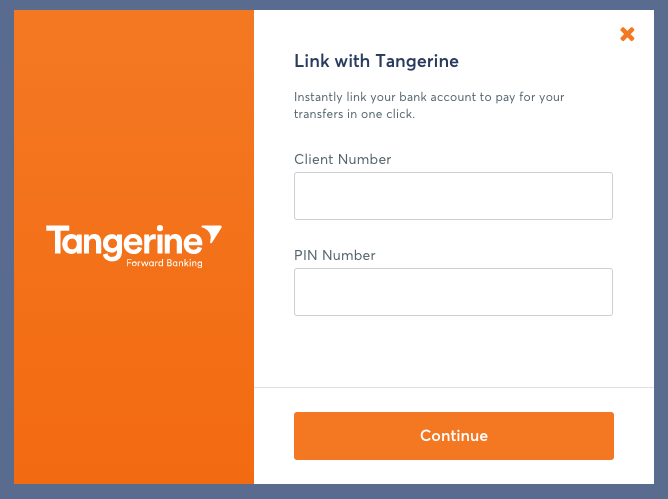

You can set up direct debit via the TransferWise console by selecting direct debit and continue to payment.

2 Online Bill Pay / Bill Payment

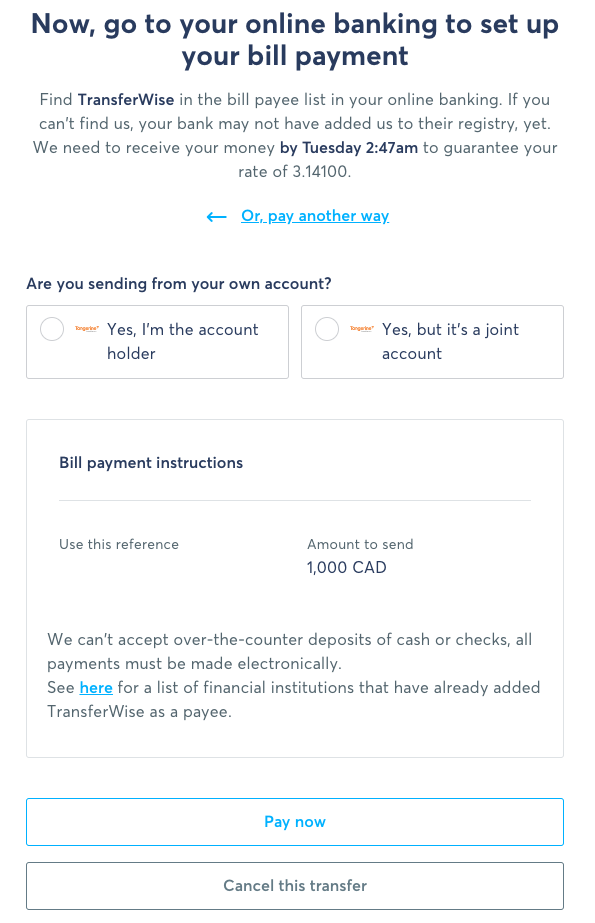

The second option that I recommend is online bill pay. However, it seems to be working with fewer banks.

However, on TransferWise help page, it lists the steps needed to add TransferWise as a payee. I will list here for your convenience.

The usual steps for online bill pay are as following:

- Log in to your online bank

- Select Bill Payment

- Add a Payee

- Enter the details of TransferWise:

Payee Province - ON (Ontario) Payee Name - TransferWise Account number- Your TransferWise membership number (Starts with an uppercase P, no spaces or dashes)

- Select Verify Payee

After you’ve added TransferWise as a bill payee with your bank, you can use this payment method again with ease.

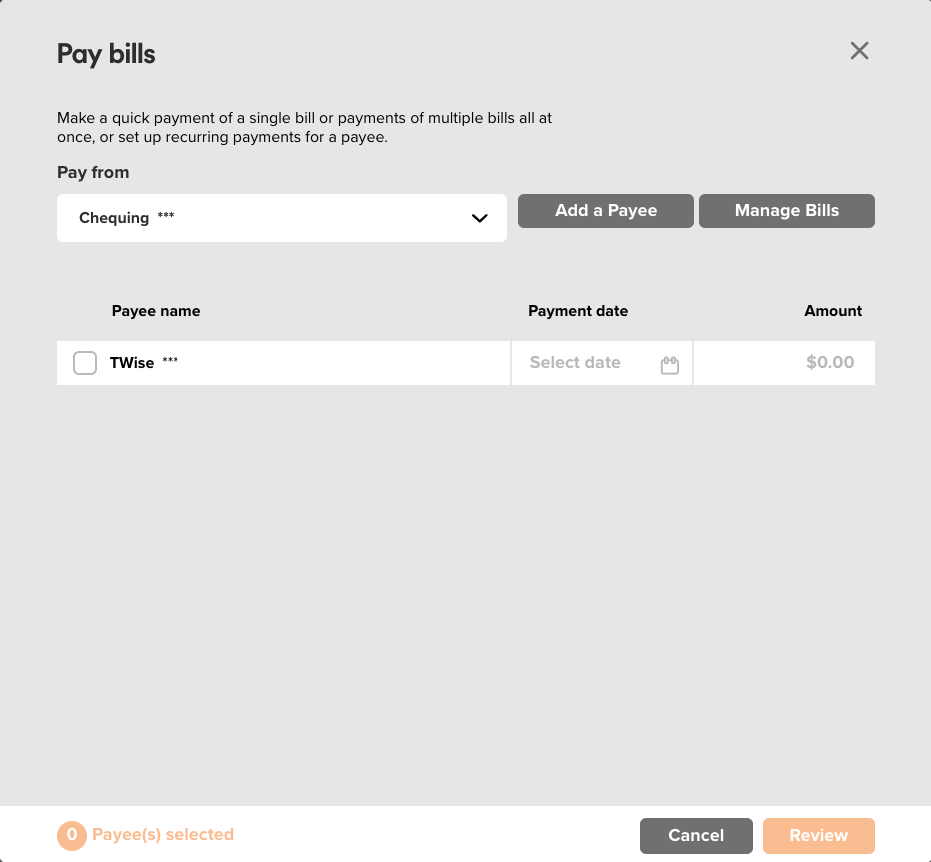

For example, this is how my bill payment menu looks like after I added TransferWise as my bill payee with my Tangerine account.

Compare with Bank Exchange Rates

To verify that you will pay less fee or transfer money overseas at a better exchange rate, you can compare TransferWise rate with the foreign currency buying rate (TT - Telegraphic Transfer) that you can find on your bank website.

Freebie

Feel free to contact me if you would like to get discount for your first international wire transfer(about $800) with TransferWise.

If you are interested in using Tangerine Bank(online bank), you can use my Tangerine Orange Key: 47618967S1 to sign up for an account. Both of us would be able to get $50 once Tangerine is able to verify your account. Thank you.

Support Jun

Thank you for reading!

If you are preparing for Software Engineer interviews, I suggest Elements of Programming Interviews in Java for algorithm practice. Good luck!

You can also support me by following me on Medium or Twitter.

Feel free to contact me if you have any questions.

Comments